How does warning VAT registration work in Inyett Detect and AutoPay Detect?

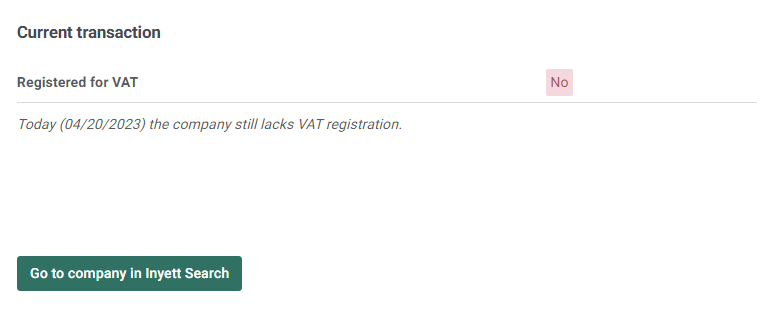

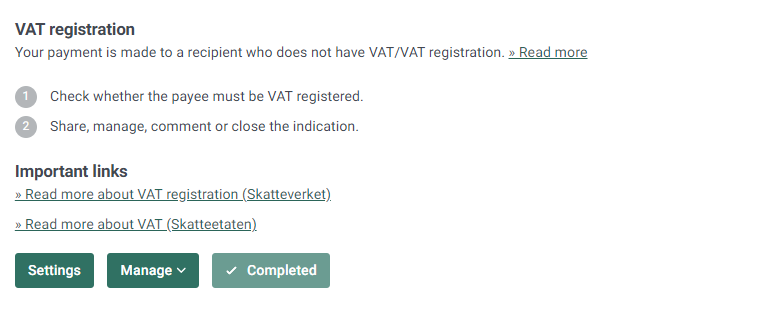

Warning VAT registration indicates when a payment is made to a recipient who does not have VAT registration.

Adjust the settings for warnings associated with VAT registration.

Click on Settings to customize how the warning for VAT registration should work. The setting is only possible for you with administrator rights.

To add or adjust settings, click the Active Settings.

With the Snooze function, a new warning is generated only after 30, 90 or 180 days from the previous warning of the same type to the same payee. Snooze works as a pause function.

Click on Excluded Account Numbers, Excluded Organization Numbers to exclude account numbers/organization numbers and avoid warnings for VAT registration . Then tap Exclude.

It is also possible to delete previously excluded entries by clicking on the trashcan. The setting is only possible for users with an administrator role.

Click on Go to all settings to see all compiled settings for warnings and to be able to turn off a warning.

To manage/document a warning click HERE for more information.