How does the warning Deviating amount patterns work in Inyett Detect and AutoPay Detect?

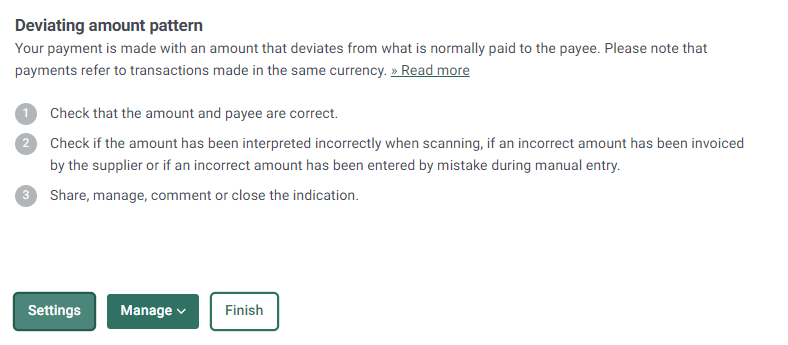

Warning Deviating amount pattern warns when a payment is made with an amount that deviates from what is normally paid to the payee. Warning Deviating amount patterns only apply to excess amounts and payments that relate to transactions made in the same currency. For the warning to be generated, more than 50 historical transactions are required. If the value of the transaction is greater than the previous largest amount, a warning is generated. The check is run on the minimum and maximum amount of the historical amounts.If it is a credit transaction, no warning is generated.

Examples of when a warning Deviating amount patterns are generated can be a misinterpreted invoice at the time of scanning, or in the case of manual setup, it can mean that invoice lines or amounts are perceived incorrectly, and thus also paid out in deviations from the financial system. A deviant payment pattern can also mean signs of a breach of contract, where the supplier has charged more than was normal, or previously agreed upon.

Adjust the settings for warnings associated with Deviating amount patterns.

Click Settings to customize how the Deviating amount pattern warning works. The setting is only possible for you with administrator rights.

To add or adjust settings, click Active Settings. This setting creates payment patterns per sender account. Each account can have unique patterns for the same recipient, which helps better identify deviations when the amounts vary.

Click on Excluded Account Numbers, Excluded Organization Numbers to exclude account numbers/organization numbers and avoid warnings for Deviating Amount Patterns. Then tap Exclude.

It is also possible to delete previously excluded entries by clicking on the trashcan icon. The setting is only possible for users with an administrator role.

Click on Go to all settings to see all compiled settings for warnings and to be able to turn off a warning.

![]()

To manage/document a warning click HERE for more information.