How does warning F-tax work in Inyett Detect and AutoPay Detect?

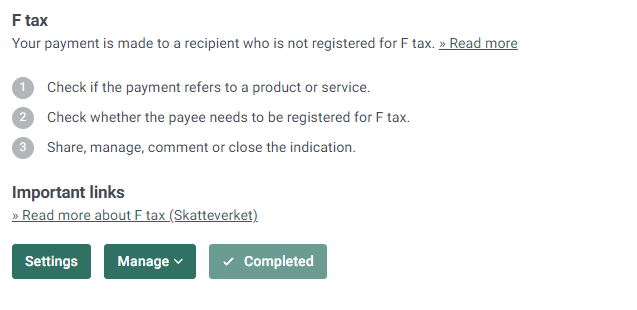

Warning F-tax warns when a payment is made to a recipient who is not registered for F-tax.

Note that non-profit associations are not audited or warned about F-tax because they do not necessarily need to have F-tax if they are not for profit.

Adjust the settings for warnings associated with F-tax.

Click on Settings to exclude payees/account numbers from warnings.

Click on Excluded Account Numbers, Excluded Organization Numbers to exclude account numbers/organization numbers and avoid warnings for F-tax. Then tap Exclude.

It is also possible to delete previously excluded entries by clicking on the trashcan. The setting is only possible for users with an administrator role.

Click on Go to all settings to see all compiled settings for warnings and to be able to turn off a warning.

To manage/document a warning click HERE for more information.